- Sydney Family Lawyers

- (02) 9633 1088

- mail@sbfamilylawyers.com.au

Binding Financial Agreements – Prenuptial Agreements Lawyers Sydney

Binding Financial Agreements | Prenuptial Agreements | Postnuptial Agreements | Asset Protection | Marriage | De Facto | Separation | Divorce | Financial Agreements

Binding Financial Agreements. This article is an introduction to Binding Financial Agreements. It is not intended as legal advice. If you are considering a financial agreement before, during or at the end of your marriage or de facto relationship you should consult an expert family lawyer.

What is a Binding Financial Agreement? (BFA)

The term “pre-nup” or “prenuptial agreement” is commonly heard in today’s media and amongst people considering domestic relationships or the end of domestic relationships.

In today’s legal context the term “Binding Financial Agreement” is more appropriate and encompasses agreements regarding the finances and assets of couples (including same-sex couples) before they enter into a relationship, during a relationship and when a relationship comes to an end.

Financial Agreements are a type of contract that, when drafted and executed properly, bind the parties under statute law and limit the rights of parties regarding financial proceedings through the Court system. Binding Financial Agreements can therefore be used to avoid Court proceedings and can provide asset protection but should also be entered into carefully for numerous reasons outlined in this article.

The Courts have often taken a strict view in interpreting the law in regards to these agreements and there are many formalities and considerations that need to be addressed by you and your family lawyer.

Formalities of a Binding Financial Agreement

What’s required to make a Binding Financial Agreement Valid?

There are a number of formalities that must be adhered to for the Courts to consider a Binding Financial Agreement valid. These include:

- The agreement needs to be signed by all parties.

- Before signing the agreement, all parties need to seek independent legal advice regarding the effect of the agreement on their rights and the advantages and disadvantages of the agreement.

- The lawyers need to provide to their own client a signed statement that they have provided the advice referred to above. That statement must also be provided to the other party.

Binding Financial Agreements entered into prior to, or during, a relationship require one or both of the parties to complete a separation declaration upon the parties separating, before the Binding Financial Agreement takes effect.

In New South Wales it is possible to include a deed of release within the financial agreement which prevents a claim by a partner against the estate of the partner that predeceased them.

Enforceability and Effect of a Binding Financial Agreement

Where formalities have not been strictly adhered to and complied with, it is possible to ask the Court to make a declaration that the Financial Agreement is binding on the parties. The Court can only do this if it considers it unjust and inequitable for the Financial Agreement not to be binding.

Where a party fails to comply with the provisions of a Binding Financial Agreement, it may be necessary for one party to seek enforcement orders in the Family Court of Australia or Federal Circuit Court.

In determining the enforceability and effect of a Binding Financial Agreement, the Court is required to consider the same issues as those for contracts generally.

Termination of a Binding Financial Agreement

The death of one of the parties does not terminate the Binding Financial Agreement. Pursuant to the Family Law Act, a Binding Financial Agreement will continue to operate even after the death of a party. This means that the agreement may affect the estate of the deceased even if not explicitly stated in the agreement.

…a Binding Financial Agreement will continue to operate even after the death of a party

The parties can agree to terminate a Binding Financial Agreement. If so, this must be done by a further formal agreement known as a Termination Agreement.

Sometimes parties wish the Binding Financial Agreement to be terminated upon the occurrence of a specific event. If so, this must be drafted into the agreement through specific clauses indicating what should be done in that event. This can include reverting to the Court’s jurisdiction in particular circumstances.

In certain circumstances, a party can apply to the Court to ‘set aside’ the Binding Financial Agreement. There are a number of reasons why a Binding Financial Agreement may be set aside, and the Court has discretion in determining whether or not its power to set aside should be exercised.

Further, a Binding Financial Agreement may be set aside where:

- If it will cause hardship in situations where there is a material change in the circumstances of the parties’ child;

- There was duress, that is illegitimate pressure exerted on a party to sign the agreement;

- There has been fraudulent activity in relation to the agreement;

- Where the intent of the agreement has been to defraud a creditor;

- Where it is unenforceable or void due to mistake, misrepresentation, incompleteness, uncertainty, breach or public policy; and

- Where there was unconscionable conduct when the agreement was entered into.

These circumstances are not an exhaustive list of situations in which a Binding Financial Agreement may be set aside by the Courts. The cases heard by the Court in relation to Binding Financial Agreements have widely ranging outcomes, which usually depend on the very specific circumstances of each case. For this reason, it is important to seek specialist family law advice and to strictly adhere to the formalities stipulated in the Family Law Act.

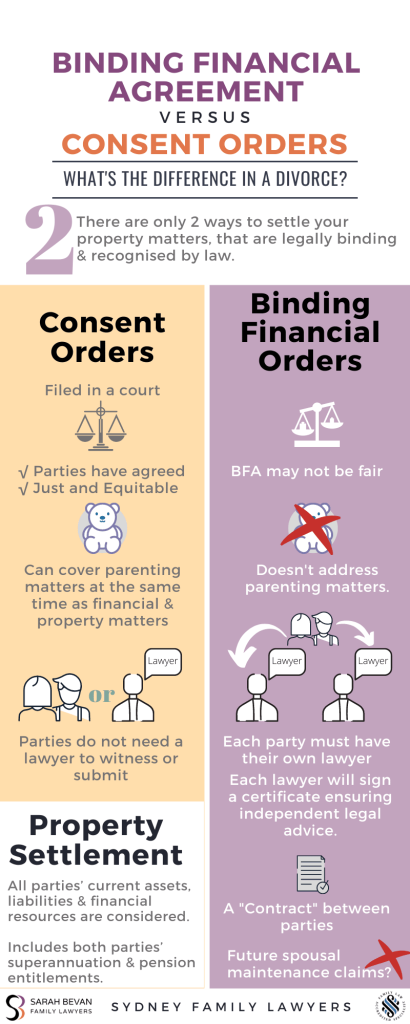

Consent Orders as an Alternative

Click here to see our INFOGRAPHIC on the difference between BFA’s and Consent Orders.

Where a financial agreement is sought upon the termination of a relationship, consent orders filed with the Court may be a more appropriate alternative. Once filed with the Court, and the Court then makes the requested orders, the consent orders are binding on the parties. There are still circumstances in which those orders can be set aside but there are significantly more limited reasons to set aside consent orders than to set aside Binding Financial Agreements.

Things to consider before seeing your family lawyer

When parties enter into Binding Financial Agreements prior to, or during, a relationship, they will be unaware of how their circumstances may change in the future. While some circumstances may be expected, such as the birth of children for young couples, there are many situations that may never be contemplated.

Even with the very best of intentions at the start of a relationship, couples may consider arrangements on separation which seem fair based on their current, or expected, circumstances but which may be highly unfair in the event of certain unexpected circumstances.

Given the demands of day-to-day life, a Binding Financial Agreement entered into at the start of a relationship may not be given much if any thought by the couple, until it is too late.

A Binding Financial Agreement will not normally be set aside if it is merely unfair to one party which exemplifies the importance of receiving independent legal advice explaining the advantages and disadvantages and ramifications of the agreement.

The effect of the agreement on third parties such as family members and creditors should also be considered so that they can be factored into the agreement where necessary or provided for outside of the agreement.

You should discuss the effect and enforceability of a proposed Binding Financial Agreement with Sarah Bevan Family Lawyers, who are specialist family lawyers experienced in the area of financial agreements.

Your lawyer will discuss with you the best way to draft the agreement and the effect and potential issues that may arise.